Blockchain has been seized upon by the financial services sector, where it is playing a crucial role in tracking and authenticating transactions.

Filter insights by:

Showing 16 of 18 content results

GrowthiQ

Is blockchain right for your business?

growthiQ

How to steer your company to long-term success

History has something important to tell us about the difficulties of steering a business to long-term success – through seismic shifts in technology, consumer demands and product development – all of which cause many businesses to fold.

GrowthiQ

How to retain your start-up spirit

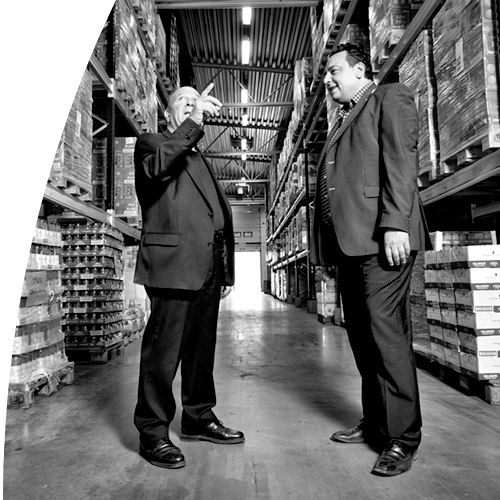

Being entrepreneurial and delivering mid-market sized turnover need not be mutually exclusive. Sweden’s Fontana Food has achieved the best of both worlds

GrowthiQ

How to plan for the future

Predicting the future need not be a stab in the dark. There are plenty of practical steps businesses can take to prepare for the challenges ahead.

GrowthiQ

Transform your business with the Internet of Things

Every business can benefit from the Internet of Things – just start small and choose wisely when deciding which operations you want to target.

GrowthiQ

Age is no barrier

India’s young, growing workforce and China’s ageing population put Asia’s two great economies at either end of the age dividend. Partners at Grant Thornton discuss the consequences for each of their countries.

GrowthiQ

Why every company needs a purpose

An increasing number of commentators and researchers think there might be a link between purpose and growth. So what does a purpose look like, and how can you define yours?

GrowthiQ

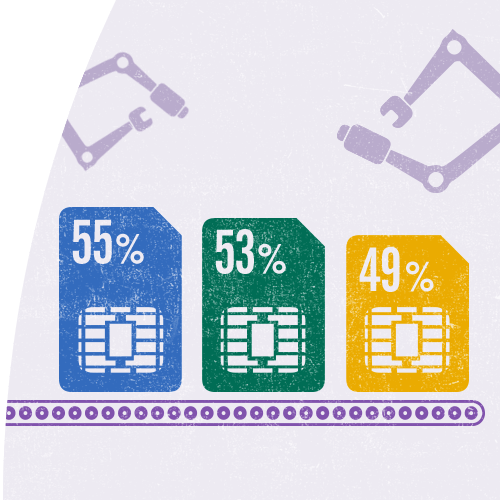

Automation: the pros & cons

Rising labour costs and the quest for productivity are driving businesses to automate. Finding new roles for redundant workers will be the next challenge.

GrowthiQ

How to give up the CEO’s chair

Giving up the CEO role is one of the toughest challenges an entrepreneur will face, but doing it successfully will help their business to grow. This article draws on experience of Swedish CEOs and advisers to help business leaders make the transition smoothly.

Beyond Borders

Why businesses expand overseas

More businesses are spurred on by a ‘fear of missing out’ (known colloquially as ‘FOMO’) than by a positive desire for growth when expanding abroad, according to new research from Grant Thornton's International Business Report (IBR). Business leaders are a fifth more likely to expand when presented with a negatively framed scenario than with the exact same scenario that was framed positively.

GrowthiQ

Using crowdfunding to grow

Video case study: UK company Berry White used crowdfunding platform CrowdCube to scale up internationally. Here's how they did it.

GrowthiQ

Going beyond borders

Advances in technology and logistics allow businesses to expand across borders more easily, but understanding and overcoming the psychological barriers to expansion abroad is crucial to giving your global growth plans a head-start.

GrowthiQ

Global tax reform: it’s time to act

Francesca Lagerberg says the global backlash against corporate tax avoidance means companies that trade across borders need to get their tax affairs in order sooner rather than later

GrowthiQ

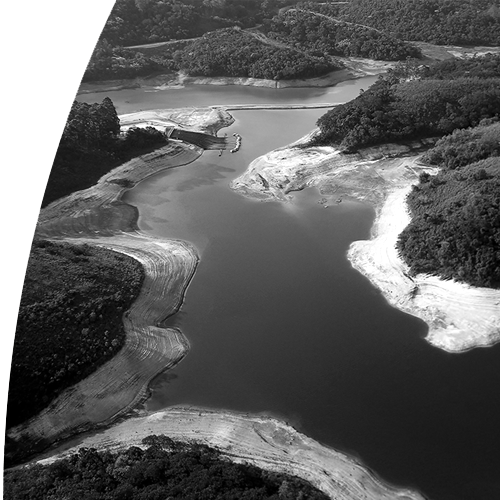

Why you need to consider natural capital

Businesses need to open their eyes to the benefits of measuring and valuing natural capital says global leader for energy & cleantech Nathan Goode.