Offshore Updates

Outbound investment is not merely the act of establishing a legal entity abroad. For years, it has been an integral component of broader strategies in capital management, tax optimization and expanding access to global markets.

However, the global legal landscape is undergoing a significant transformation. Governments and international organizations are tightening disclosure requirements to promote transparency and prevent illicit financial activities. As a result, outbound investment today demands not only optimal structuring but also credible governance and adherence to international compliance standards.

Vietnam’s Outbound Investment Landscape

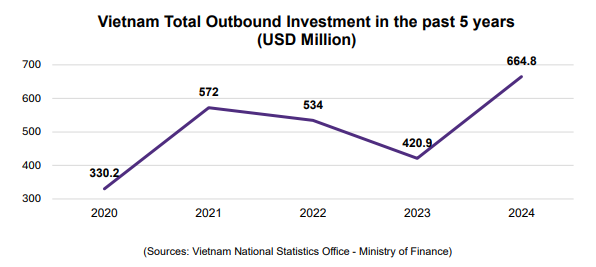

Affected by the COVID-19 pandemic and global geopolitical uncertainty, Vietnam’s outbound investment flows saw considerable fluctuations during 2020–2024, falling to USD330.2 million in 2020 and rising to USD664.8 million in 2024. Most enterprises focused on professional, scientific, and technical activities, and manufacturing - reflecting corporate recovery and efforts to diversify in response to global supply-chain shifts.

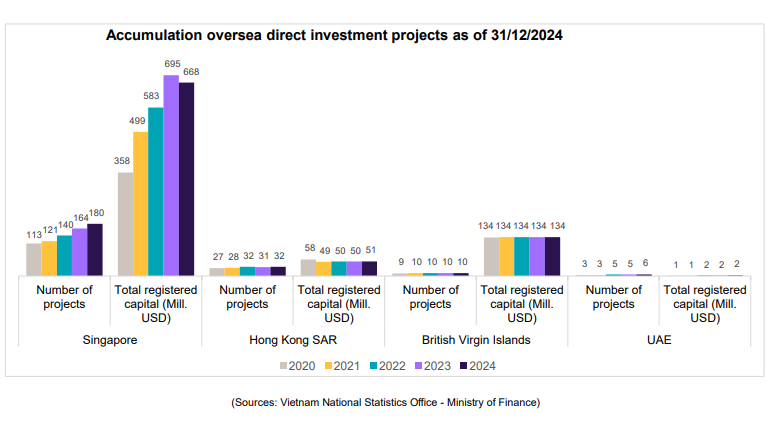

The jurisdictions of common interest include the British Virgin Islands (BVI), Hong Kong SAR, Singapore, and the United Arab Emirates (UAE. These jurisdictions play an important role in connecting Vietnamese capital with the global financial system

Over the past five years, investment flows into international financial centres have generally remained stable, according to Vietnam National Statistics Office The number of projects and total registered capital in the BVI have shown little change. Once regarded as an attractive “tax haven,” the BVI appears to be gradually losing its appeal among Vietnamese investors. This is primarily due to rising international compliance pressure and heightened expectations regarding transparency and legal credibility. The BVI was previously placed on the European Union’s tax blacklist for failing to meet international standards on information exchange, automatic exchange of information, oversight, and anti-base-erosion measures. Although it was later removed from the list after implementing a series of reforms, the incident left a notable reputational impact, making many investors more cautious when using BVI structures.

Similarly, Hong Kong SAR has seen only marginal increases in new Vietnamese investment projects, signaling a slowing trend in a market once considered among the region’s leading financial centers. Meanwhile, the UAE has attracted a relatively small number of projects, reflecting its position as a developing financial hub and an emerging potential destination for Vietnamese capital.

In this context, Singapore has risen as the most favored destination. With an advanced governance environment, a transparent legal system, and an extensive network of Free Trade Agreements (FTAs) and Double Taxation Agreements (DTAs), Singapore offers the balance between compliance and competitiveness that investors increasingly seek. As of the end of 2024, the number of active Vietnamese projects in Singapore increased by 59%, while cumulative capital rose by 86% compared with 2020.

These shifts reflect a strategic change among Vietnamese businesses: moving away from tax-driven structures in loosely regulated environments and toward stability, credibility, and alignment with international governance standards.

This transition stems not only from investor strategy but also from regulatory reforms within these jurisdictions. Under growing pressure from international bodies, multiple transparency-enhancing and compliance-driven regulations have been introduced—most notably the economic substance requirements applied to BVI entities. These reforms are reshaping how cross-border structures are designed and operated both in Vietnam and across the region.

Governance Over Geography: What Vietnamese Investors Should Keep in Mind

Vietnamese investors expanding abroad must comply with requirements including outbound investment registration, capital-source verification, periodic reporting, fulfillment of tax obligations, and other related procedures. Such requirements enhance transparency and oversight by authorities such as the Ministry of Finance, the State Bank of Vietnam, and, for large-scale projects, the Prime Minister or the National Assembly. This process often requires significant preparation and time to ensure project timelines are maintained.

After obtaining approval, investors must comply with two separate legal frameworks. On one hand, they must meet Vietnam’s domestic requirements for periodic outbound investment reports. On the other hand, they must satisfy legal and tax obligations in the destination jurisdiction, including company incorporation, anti-money-laundering (AML) compliance, “Know your client” (KYC) procedures, and related requirements. Many investors encounter difficulties proving beneficial ownership or the source of funds, resulting in denied or delayed bank-account applications. This dual compliance burden often leads to documentation gaps or procedural errors, exposing investors to risks of licensing delays or administrative penalties.

In addition, the benefits of FTAs and DTAs between Vietnam and partner countries remain underutilized, largely due to limited tax-planning capacity. Weak internal controls over offshore entities—such as failing to update registers of members, file Annual Returns, or maintain proper accounting records—also increase legal risk and affect corporate credibility.

These challenges demonstrate that outbound investment should be viewed as a strategic governance activity rather than a mere administrative procedure. As global regulations tighten, compliance, transparency, and structured planning are no longer optional—they form the foundation for the sustainability and legitimacy of Vietnam’s international investment footprint

Looking Ahead: When Compliance Becomes a Strategic Advantage

Offshore structures continue to play a vital role in global finance, providing legitimate vehicles for investment and cross-border expansion. However, the “rules of the game” are changing. Transparency, compliance, and alignment with international standards are no longer optional - they have become strategic requirements for long-term growth.

For Vietnamese businesses expanding abroad, the message is clear: success in cross-border investment now depends not only on cost optimization, but on credible governance and integration with global practices. To adapt, Vietnamese enterprises need a forward-looking compliance strategy that integrates legal, tax, and operational planning from the earliest stages. Building transparent structures, maintaining accurate cross-border reporting, and leveraging FTAs and DTAs effectively can transform compliance from a legal burden into a competitive advantage.

Contact us