In this regular series, we analyze capital flows, the sectors attracting investor attention, and the market dynamics influencing investment behavior. Whether you are actively seeking opportunities or simply keeping an eye on the market, we hope these insights will help you stay up to date with the latest trends.

In brief of Aug-2025 momentum

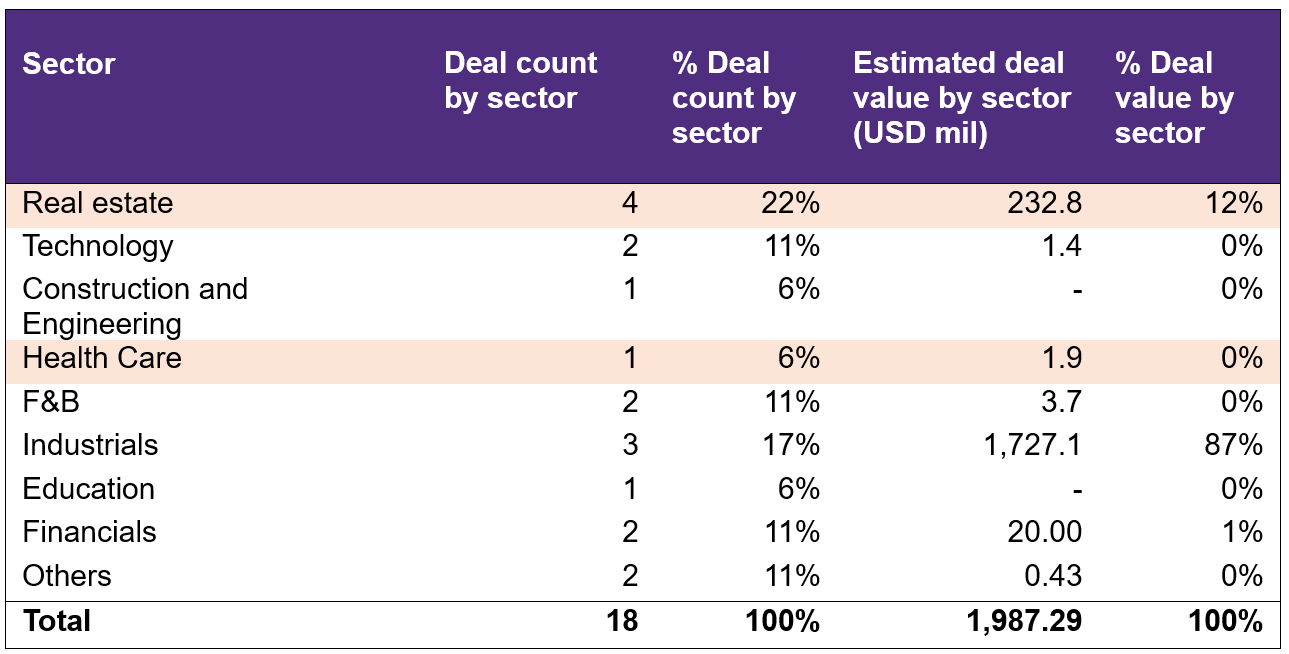

- In August, Vietnam’s M&A market recorded 18 deals with an estimated total value of around USD 1.98 billion.

- Strategic M&A transactions continued to dominate in terms of volume, while overall deal value during the month was largely contributed by corporate restructuring deals (76%).

- Real estate, Industrial Manufacturing, and Financial Services remained the leading sectors both in terms of deal count and transaction value.

M&A Market Overview

In August, Vietnam’s M&A market recorded 18 transactions with total announced and estimated value reaching around USD 1.98 billion. Real Estate, Industrial Manufacturing, and Financial Services continued to lead both in terms of deal volume and value.

From a value perspective, August significantly outperformed July despite having fewer transactions, largely driven by VinFast’s USD 1.5 billion restructuring deal, alongside a strategic deal in the Real estate sector exceeding USD 200 million.

In terms of volume, Real Estate maintained its momentum and remained the most active sector. It was followed by Industrials and Financial Services, which continued to attract strong interest from foreign investors, particularly from Japan and South Korea.

Another noteworthy point is that August did not record any direct investments from funds. Instead, the market saw announcements related to successful fundraising or capital commitment plans. With available capital on the rise, we can expect to see more fund-driven investment transactions emerging in Q4 this year.

Source: Capital IQ, Grant Thornton Research and analysis.

M&A Deal Highlights

Real estate

- SSG Group acquired 11.92% of shares in Seaprodex (SEA) from Red Capital and Gelex. The transaction was executed via private placement on 22 August 2025, with a total value of approximately VND 507 billion (USD 20 million). Post transaction, SCIC remains the controlling shareholder with a 63–64% stake, while SSG becomes the second-largest shareholder in Seaprodex. Known for its high-end real estate projects such as Saigon Pearl and Thao Dien Pearl, SSG’s participation in Seaprodex reflects its strategy to capitalize on the prime land bank held by the company.

- Gelex Infrastructure JSC, a subsidiary of Gelex Group (HOSE: GEX), acquired the entire equity interest of Savico (HOSE: SVC, a subsidiary of Tasco – HNX: HUT) in the Can Gio High-End Residential Project (29.83 ha, Ho Chi Minh City). The project originated from a 2002 business cooperation contract between Savico and Fideco, under a 50–50 capital contribution. The deal was carried out through a public auction, with a total transaction value of VND 619.44 billion (USD 24.5 million).

- Viet Minh Hoang Real Estate Investment and Construction JSC (a related company of Sun Group) acquired the Constrexim Complex Project (2.5 ha, Lot A1-2, Cau Giay New Urban Area, Hanoi) from CTX Holdings. The project is planned for five towers ranging from 38–45 floors. Following the transaction, Sun Group renamed the project Sun Feliza Suites and launched commercialization plans. According to CTX Holdings’ consolidated Q2/2025 financial statements, the company recorded a deposit of VND 4.964 trillion (USD 195 million), although the total transaction value has not been disclosed.

Technology

- On August 29, 2025, Appirits Inc. (TSE:4174) announced an agreement to acquire 100% of Bunbu Joint Stock Company from individual shareholders. Founded in 2010, Bunbu specializes in developing web, mobile, and AI systems for Japanese clients. The transaction forms part of Appirits’ VISION2030 strategy, which aims to expand its technical capabilities and talent base through M&A, leveraging Vietnam’s strong technology resources to enhance service quality, optimize costs, and strengthen its international presence.

Industrials

- HD Korea Shipbuilding & Offshore Engineering (HD KSOE), a member of the HD Hyundai ecosystem, has acquired 100% of Doosan Vina from Doosan Enerbility in a transaction valued at approximately USD 210 million. Established in 2006 in the Dung Quat Economic Zone (Quang Ngai), Doosan Vina manufactures equipment for thermal power plants, LNG modules, and port cranes. Following the acquisition, HD Hyundai plans to build a new facility on the Doosan Vina site to produce LNG and ammonia eco-friendly storage tanks, while developing the unit into a regional hub for port crane manufacturing. For Doosan Enerbility, the divestment of Doosan Vina is part of its portfolio restructuring strategy, allowing it to focus resources on new energy sectors such as small modular reactors (SMRs), gas turbines, and hydrogen.

- On 14 August 2025, VinFast Auto Ltd. announced the establishment of Novatech JSC, a research and development subsidiary, and transferred 62% of its charter capital to Mr. Pham Nhat Vuong for approximately USD 1.5 billion. After the transaction, Mr. Vuong holds 62.32% of Novatech’s charter capital, while VinFast retains 37.64%, but controls 99.9% of voting rights. This restructuring deal separates the R&D segment from VinFast to strengthen financial resources, while positioning Novatech as an independent technology hub within the Vingroup ecosystem.

Financials

- Daiwa Securities announced plans to purchase nearly 16 million shares of SSI through a private placement at VND 31,300 per share (USD 1.25), with a total value of over VND 497 billion (USD 19.9 million). Currently, Daiwa is SSI’s largest shareholder with 301 million shares (15.25% stake); after the transaction, its holding will increase to more than 317 million shares. The deal is expected to take place between 29 August and 26 September 2025. Established in 1902, Daiwa Securities Group is one of Japan’s “Big Four” securities firms, operating in brokerage, investment, and asset management.

Other Notable Information

- SIFEM (The Swiss Investment Fund for Emerging Markets) has committed USD 20 million to ECVP II (Excelsior Capital Vietnam Partners II) – Excelsior Capital’s second Vietnam-focused fund with a total size of USD 200 million. The investment will support ECVP II’s strategy of targeting small and medium-sized enterprises in the consumer, education, healthcare, logistics, and technology sectors, while reaffirming SIFEM’s confidence in the long-term growth potential of Vietnam’s private sector.

- IFC is considering an investment of up to USD 200 million in a privately placed 5-year sustainability bond issued by VPBank. The proceeds would be used to finance climate-related projects, SME lending, and to promote best practices in sustainable bond standards within Vietnam’s banking sector.