In this regular series, we analyze capital flows, the sectors attracting investor attention, and the market dynamics influencing investment behavior. Whether you are actively seeking opportunities or simply keeping an eye on the market, we hope these insights will help you stay up to date with the latest trends.

In brief of November 2025 momentum

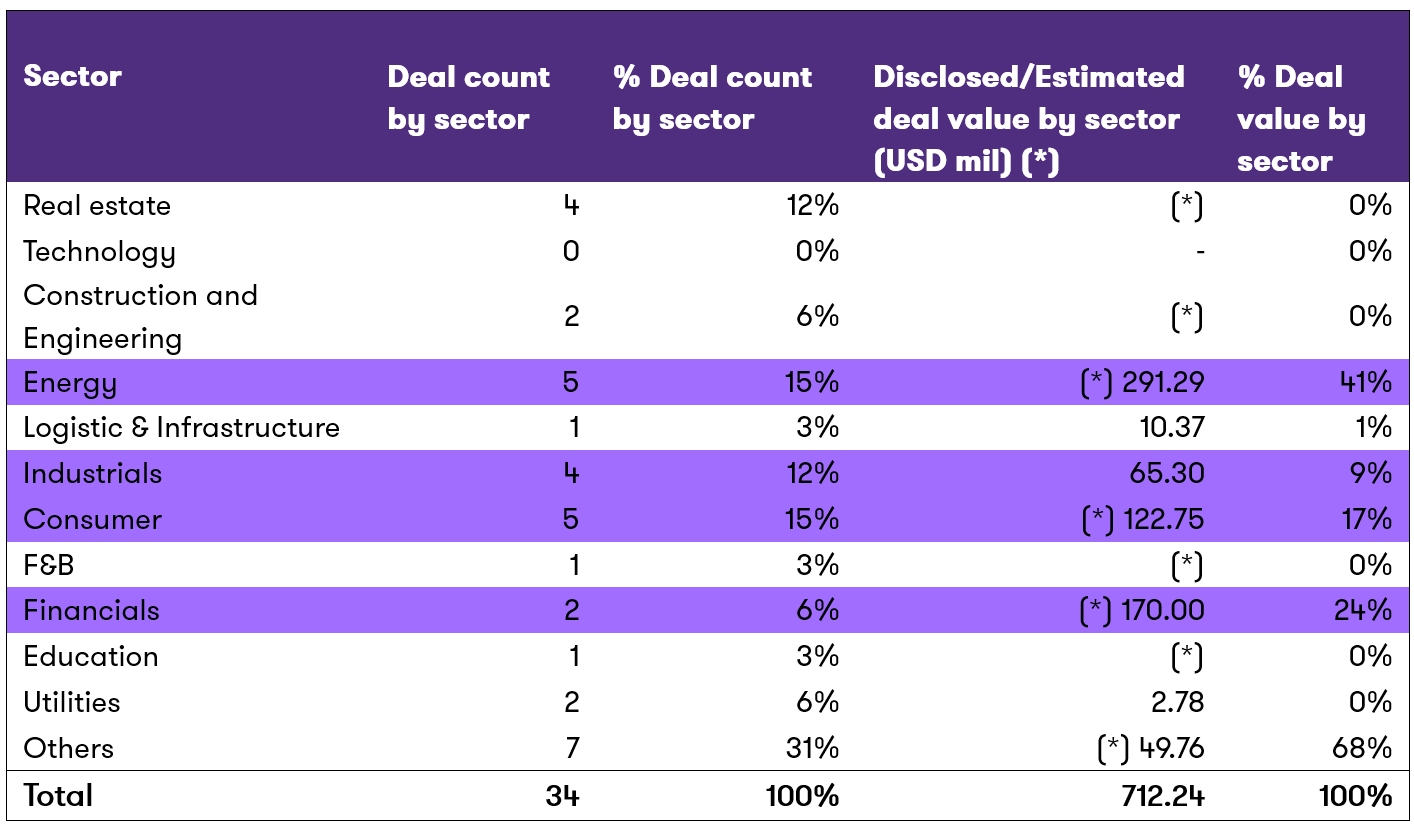

- In November, Vietnam’s M&A market recorded 34 deals with an estimated total value of around USD 712.2 million.

- Following the vibrant momentum of October, the M&A market in November continued its pace with a series of strategic deals led by foreign investors.

- Energy, Financial Services, Consumer, and Industrials were the leading sectors in terms of deal value.

M&A Market Overview

In November 2025, Vietnam’s M&A market recorded 34 deals with a total disclosed and estimated value of approximately USD 712.2 million. Energy, Financial Services, Consumer, and Industrials were the leading sectors in terms of both value and deal volume.

In terms of disclosed/estimated value, Energy, Financial Services, and Consumer were the top sectors, with estimated/disclosed transaction values of USD 291 million, USD 170 million, and USD 123 million, respectively. The M&A market in November was driven by strategic investments from foreign investors.

Regarding deal volume, sector diversity continued to be maintained, with Energy and Consumer accounting for the largest number of deals, with five deals each sector.

Source: Capital IQ, Grant Thornton Research and analysis.

(*) The transaction values presented in the table include only disclosed or estimated values and do not represent the full value of all deals. Out of a total of 34 transactions in November, we were able to determine the value for 16 deals, while 18 deals had no available value information.

Notable M&A transactions

Energy

- Brookfield Asset Management, a global investment group headquartered in New York with over USD1 trillion in assets under management, has made its first renewable energy investment in Vietnam. Through its Catalytic Transition Fund, Brookfield acquired an operating wind power project with a capacity of 100 MW under a long-term power purchase agreement. The transaction value was not disclosed.

- AboitizPower (Philippines) announced the acquisition of a 25% stake in Van Phong Power Company (VPCL) from Sumitomo Corporation for approximately USD 220 million. VPCL owns the Van Phong 1 Thermal Power Plant in Khanh Hoa, with a capacity of 1,320 MW, which commenced commercial operations in 2024 and is expected to supply around 8.5 billion kWh annually.

Industrials

- Korea Circuit Vina (KCV) announced a USD 13 million investment from Interflex Co., Ltd. (South Korea). Interflex is a manufacturer of FPCBs and electronic components with factories in South Korea, China, and Vietnam. The new capital will support the expansion of KCV’s electronic component plant at the Dong Soc Industrial Cluster (Phu Tho).

- Panjit International Inc. (Taiwan) acquired a 95% stake in Torex Vietnam Semiconductor from Torex Semiconductor Ltd. Torex Vietnam, located in VSIP II Industrial Park (Binh Duong), specializes in IC packaging and testing using ultra-small USP technology. The deal enables Panjit to expand its manufacturing footprint in Southeast Asia and strengthen its supply capabilities for AI, automotive, power, and green energy markets. The estimated transaction value is around USD10 million.

- Tasco Investment completed a negotiated purchase of over 39.1 million shares of DNP Holding (HNX: DNP) between October 21 and November 20, becoming a major shareholder with a 27.8% stake. The company has subsequently registered to acquire an additional 52 million shares to increase its ownership to approximately 65% of charter capital, with the transaction expected to take place from November 28 to December 26.

Consumer

- PAN Group (HOSE: PAN) has completed the divestment of Bibica (HOSE: BBC) to Sari Murni Abadi (Indonesia), the owner of the Momogi snack brand. The deal marks PAN’s exit from Bibica after eight years and paves the way for SMA to strengthen its presence in Vietnam’s confectionery market. The transaction value was not disclosed. Bibica currently operates two factories in Long An and Hanoi and has a distribution network of over 100,000 points of sale.

- KIDO Group (HOSE: KDC) is seeking shareholder approval to transfer its remaining 49% stake in KIDO Foods (KDF) to Nutifood or an entity designated by Nutifood. The transaction, involving more than 36.3 million shares, is expected to generate approximately VND 2,500 billion (around USD 95.2 million). Following the deal, KIDO will exit the ice cream and frozen food segment.

- T. Hasegawa Co., Ltd. (TSE: 4958) has signed an agreement to acquire 100% of Hoang Anh Flavor & Food Ingredients JSC for a total value of approximately VND 725 billion (equivalent to USD 27.6 million). The acquisition enables T. Hasegawa to expand its operations in Vietnam, a market considered a key focus in its regional growth strategy. Hoang Anh specializes in producing food flavorings for companies in the food and beverage industry.

Real estate

- Phu My Hung has transferred a 49% stake in the legal entity owning the Hong Hac City project (nearly 198 hectares, Bac Ninh) to Nomura Real Estate Asia. The project has a total investment of approximately USD 1.1 billion as announced by both parties. Following the transaction, the two companies will jointly develop an international-standard urban area with an expected population of around 28,000, including residential, commercial, and service facilities. This marks Phu My Hung’s first expansion outside Ho Chi Minh City. The transaction value was not disclosed.

Financials

- Asahi Mutual Life Insurance Company (Asahi Life, Japan) has signed an agreement to acquire MVI Life (Vietnam) from Manulife Financial Corporation for approximately USD 170 million. MVI Life, formerly known as Aviva Vietnam, was acquired by Manulife Vietnam in 2021 and currently operates independently from Manulife Vietnam’s core business. Asahi Life, the second oldest life insurance group in Japan, has been present in Vietnam since 2017 and established a legal entity in Ho Chi Minh City in 2023. This marks Asahi Life’s first merger and acquisition deal in an overseas market.

- SBI Group, a Japanese financial and technology conglomerate, has invested in Saladin, an insurtech brokerage company in Vietnam. Saladin has been licensed as an insurance broker since 2022 and completed its Series A round in 2023. The investment from SBI Group aims to support the expansion of Saladin’s technology platform and enhance its capability to deliver insurance products. The investment size and ownership stake were not disclosed.

F&B

- Mekong Capital has fully divested its stake in Red Wok, the operator of restaurant chains Wrap & Roll, Quán Ụt Ụt, and BiaCraft. Mekong invested in Red Wok in 2016 with an initial capital of USD 6.9 million through its MEF III fund to support expansion and operational professionalization. The transaction marks the end of Mekong’s investment journey in the company, aligning with its portfolio restructuring strategy and shift toward new opportunities. The transaction value was not disclosed.

Airlines

- Vietravel Tourism JSC (UPCoM: VTR) will divest its entire holding of more than 18.463 million common shares, equivalent to approximately 14.1% of Vietravel Airlines JSC, by December 31, 2025. The divestment value is capped at no more than 10% of Vietravel’s total assets, based on its Q3 2025 internally audited financial statements. As of the end of Q3 2025, Vietravel Airlines reported total assets of over VND 3,134 billion. This transaction marks the end of Vietravel’s management role in the airline it founded in 2019, as part of a restructuring plan to refocus on tourism, services, and trade. Following Vietravel’s exit, Vietravel Airlines’ shareholder structure will include T&T Airlines, T&T SuperPort, Vietravel Group, BVIM Fund, and other individual investors.

Mining

- Nam Tien Co., Ltd. will receive an investment of VND 613.3 billion from PSG Corporation Public Company Limited (SET: PSGC) through the issuance of new common shares. Following the transaction, PSGC will increase its ownership to 64%, becoming the parent company. PSGC is a Thai enterprise specializing in infrastructure, M&E, and industrial construction with over 40 years of experience. Founded in 2006, Nam Tien operates an energy resource supply chain, including mining, logistics, and coal transportation in Laos and Vietnam.

Other notable information

Note: The following items are not included in the deal count and value summarized above; they are for reference and informational purposes only.

- The State Capital Investment Corporation (SCIC) transferred nearly 370.7 million shares (50.17%) of FPT Telecom to the Ministry of Public Security in November 2025, completing the transfer of state capital representation as agreed in July. After the transaction, the Ministry of Public Security holds the entire state-owned stake in FPT Telecom, while FPT retains approximately 45.66%. This move is considered strategic for ensuring data security, digital sovereignty, and supporting the implementation of Project 06.

- Touchstone Partners announced the launch of a USD10 million Green Transition Fund to invest in climate-tech startups in Vietnam and Southeast Asia, focusing on sustainable agriculture, circular economy, waste management, and new energy. The fund will start disbursing in December 2025, with investments ranging from USD 200,000 to USD 1,000,000 in the form of equity or convertible bonds. Touchstone Partners is an early-stage VC fund that has previously invested in companies such as Selex Motors, Alterno, Stride, Enfarm, and Forte Biotech.

- Gene Solutions plans to raise approximately USD100 million in a pre-IPO round and aims to list in 2026 in Hong Kong or Singapore to expand its genetic testing and cancer diagnostics operations in the region. Its lead investor, Mekong Capital, invested USD 15 million in 2021 and USD 21 million in 2023. Gene Solutions provides prenatal screening and cancer detection services using NGS technology combined with AI, leading the prenatal testing market in Vietnam and expanding into Southeast Asia.

- DEG (the investment arm of the German Development Bank) is considering providing a long-term loan of USD 50 million to Thanh Thanh Cong - Bien Hoa (HOSE: SBT) to support sugar production activities, amid industry restructuring and expansion into organic products, auxiliary production, and exports. Previously, in July 2019, DEG made a strategic investment of USD 28 million (approximately VND 650 billion) in TTC Bien Hoa through the issuance of convertible preferred shares, equivalent to a 3.55% stake post-issuance..