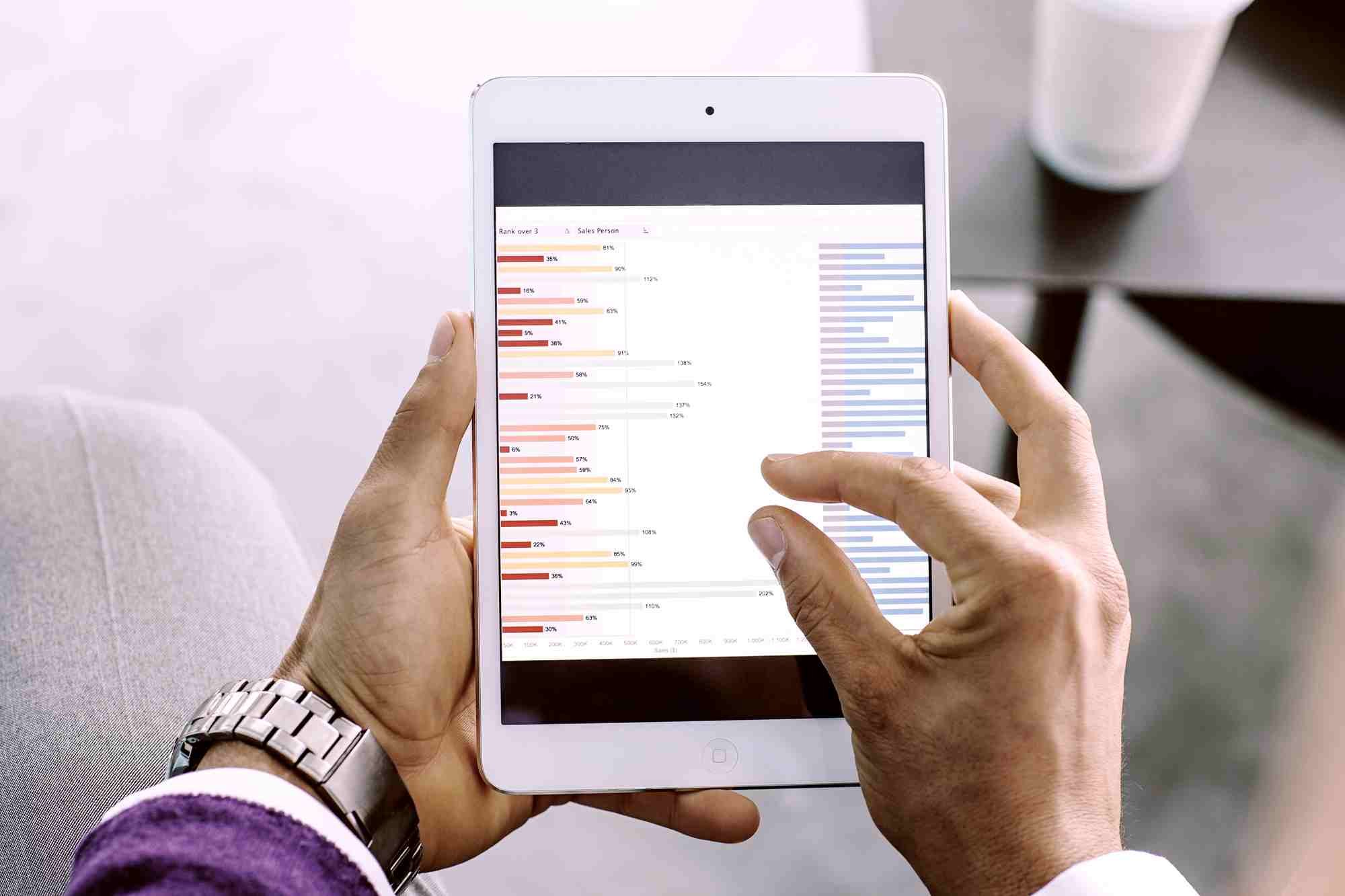

In 2025, Vietnam’s private equity investment landscape continues to undergo notable shifts including capital flows, exit strategies and the growing adoption of AI in investment practices. Grant Thornton Vietnam’s “Private Equity Survey 2025” offers a comprehensive perspective to help investors navigate and strategize amid an evolving market environment. With timely insights and in-depth analysis, this survey serves as a valuable resource for investors and businesses seeking the right opportunities and strategies in Vietnam’s private equity market.

In the wake of unprecedented economic and societal challenges, businesses are being forced to rethink their strategic objectives. Against this backdrop, the role Private Equity (PE) can play in mid-market growth is being reconsidered. The insights below explore how PE firms are adapting to the new market conditions and provide advice for mid-market businesses looking at PE as a route to growth.

Read more

Private Equity in Vietnam 2025

Bright Spots

Private Equity Insight

Steering through challenges

Grant Thornton Vietnam is pleased to announce the release of our Private Equity Survey 2023 – an edition in our Private Equity Survey series.

Mid-market businesses

Getting ready for private equity investment

Our specialists explore how private equity firms are now working with their portfolios and how the mid-market can benefit from investment.

Mid-market businesses

Myth-busting private equity

Nervous about partnering with Private Equity? We explore some of the common myths we come across when speaking to mid-market businesses about PE investment.

Private equity firms

Private equity in mid-market: reshaping strategies for 2021

When the global COVID-19 pandemic stormed across the globe in early 2020, the private equity sector was hit hard but deals are coming back to the market.

Private Equity in Vietnam 2019

Catching up and getting ahead

Grant Thornton Vietnam is pleased to announce the release of the results of our 18th survey - “Private Equity in Vietnam- Catching up and getting ahead”. The survey was conducted in March 2019.

Private Equity

Private Equity Survey in Vietnam 2023

Grant Thornton is conducting its 2023 survey on the investment outlook of the private equity sector. The survey is aimed at decision makers involved in investment activities such as corporates, advisory firms and private equity houses in addition to academics and experts across various sectors of the economy.

Private Equity in Vietnam 2020

Asia’s Rising Star

Grant Thornton Vietnam is pleased to announce the release of our Private Equity Survey 2020 – an edition to our annual Private Equity Survey series. This year survey has been conducted to capture the full impact of Covid-19 and growth opportunities despite the pandemic setback. We also cover the Value Creation Plan, a topic that has received much attention in the private equity world in recent years.

Private equity in the UK

Technology will be a shining light in M&A post-lockdown

Quarterly analysis of UK M&A trends in software, IT services (including digital transformation), fintech, advertising and marketing services.

Private equity in the UK

How will private equity be impacted by current events?

The private equity (PE) industry is feeling the pressure of the coronavirus outbreak, both in terms of deal-making and managing existing portfolios.

Private equity in the US

PE valuations shift in COVID-19 era

COVID-19 has caused PE firms to evaluate and adjust their valuation practices – postponing valuations to avoid reset triggers, exploring new approaches to valuations or diversifying existing ones.

Mergers and acquisitions

Steer your M&A growth strategy to success

Merger and acquisition remains a root but increasingly complex path to growth for many businesses, essential preparation can overcome the challenges.

Private Equity

Private Equity - Investment Outlook 2018

Grant Thornton is conducting its 2018 survey on the investment outlook of the private equity sector. The survey is aimed at decision makers involved in investment activities such as corporates, advisory firms and private equity houses in addition to academics and experts across various sectors of the economy. This is the 17th consecutive private equity survey Grant Thornton has carried out on an annual basis.