Vietnam’s Mid-Market in Q2 2025

Author

Economic optimism and uncertainty

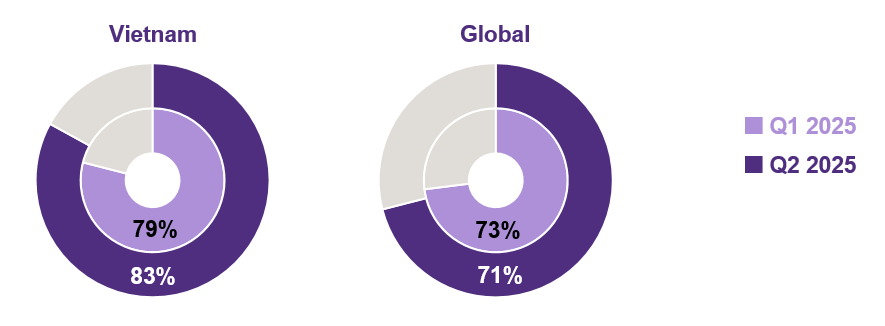

The latest Grant Thornton International Business Report (IBR) survey found that mid-market business leaders around the world are less optimistic about the economic outlook over the next 12 months, with 71% expressing optimism (down two points from Q1 2025). Meanwhile, Vietnamese mid-market businesses stand out for their high levels of optimism, even as headwinds looms large on the global stage. Specifically, 83% of Vietnamese business leaders report feeling optimistic about the economic outlook for the next year compared to 79% in Q1.

Optimism in economic outlook in the next 12 months among mid-market businesses

Yet this optimism does not extend fully to global expansion ambitions. In fact, indicators tied to cross-border intentions have declined sharply this quarter. This signals a more cautious approach to overseas expansion and an inward-focused business sentiment.

Global ambitions: Trade pressures impact international outlook

This rising sense of unease is impacting the global mid-market’s international outlook, with the proportion of business leaders expecting to increase exports down three points to 50%. Vietnam saw even a steeper decline, as only 37% of Vietnamese firms expect to increase exports over the next year, down dramatically from 60% in Q1. Globally, those expecting an increase in revenues from non-domestic markets fell four points to 48%, while in Vietnam the figure also dropped, from 55% to 44%.

Vietnam’s more cautious stance follows one of the most serious trade threats in years. In early 2025, the U.S. considered a sweeping 46% tariff on Vietnamese exports over concerns about transshipment. This triggered widespread concern among exporters, prompting many to respond in different ways: pausing overseas activities, planning for diversification, or focusing on a smaller set of trusted markets. It also appears to have influenced supplier strategies: only 26% of Vietnamese businesses now expect to increase use of non-domestic suppliers, down from 41% last quarter and well below the global average (41%). This change likely reflects a desire to reduce exposure to trade risks and aligns with the government’s push for greater domestic value-added production and supply chain self-reliance.

Following weeks of tension, high-level negotiations between the two governments produced a more favorable outcome—limiting the general tariff to 20% and applying a 40% rate to transshipped goods, which may help restore business sentiment in the period ahead.

Business constraints: Global caution and internal stability

Globally, concerns about economic uncertainty have increased, rising six points to 61%. Concerns over geopolitical disruption went up six points to 53%, a new high. Business leaders concerned about supply chains also reached a record high of 49% (up one point). Those concerned about a future shortage of orders also peaked at 50% (up three points).

Meanwhile, perceived business constraints have eased across various aspects for firms in Vietnam. The proportion of business leaders citing economic uncertainty as a major concern dropped from 70% to 57%. Fewer firms cited future shortage of orders as a major concern (52%, down from 58%), while worries about geopolitical disruptions (41%, down from 44%) and supply chain risks (47%, down from 53%) have similarly softened.

This reduction in business constraints suggests that while Vietnamese firms are more cautious globally, there might be a growing sense of internal stability, a sign of the impact of the wave of structural reforms unfolding within Vietnam’s governance and administrative system at the moment.

Internal investment intentions: Investment strategies reflect the shift

Just as governments around the world are focused on re-engineering the global economy by striking new trade deals with the United States, or searching for new trading partners, business leaders continue to focus on re-engineering their own business by investing in technology. IT remains the top investment area for the mid-market, with 68% of business leaders planning to increase spending over the next 12 months. In contrast, investment in people dropped three points to 59% – the first time it has fallen in two years. This indicates that increased investment in AI and digital infrastructure may now be happening with the purpose of enhancing operational efficiency and cost-cutting.

Mid-market firms in Vietnam are adjusting their investment strategies accordingly. Investment in branding stands out as a top priority, with 77% of businesses planning to increase spending in this area, well above the global average of 58%. Technology investment remains robust at 63%, though down from 75% in the previous quarter. Meanwhile, spending on people is showing signs of contraction: only 46% of businesses plan to invest in upskilling or workforce development (down from 66%). These trends mirror a broader global shift where digital transformation and AI are prioritized over traditional human capital development.

Contact us