In this newsletter, Grant Thornton Vietnam would like to update recent important regulations and important tax policies including:

1. Decree No. 38/2019/ND-CP on increased basic salary from 1 July 2019

The Government has just issue Decree No. 38/2019/ND-CP dated 9 May 2019 regulating the increase of basic salary for civil servants, officials and armed forces.

This Decree takes effect from 1 July 2019 and replaces Decree No. 72/2018/ND-CP, which stipulates the previous basic salary.

From 1 July, 2019, the basic salary is VND1,490,000/month (increase VND100,000/month compared to the current regulations).

Companies should pay attention to adjusting new insurance cap, minimum wages and benefits based on the new basic salary to ensure compliance with the law.

2. Guidance on conditions for determining foreign workers who are subject to compulsory social insurance

On 18 March 2019, the Ministry of Labor, War Invalids and Social Affairs provided the guidance under the Official Letter 1064/LDTBXH-BHXH on individuals who are subject to compulsory social insurance under the provisions of Decree No.143/2018/ND-CP dated 15 October 2018.

Specifically, according to this guideline, foreign workers are subject to compulsory social insurance only when following conditions are satisfied:

- Having a work permit or practice certificate or a practice license issued by a competent Vietnamese authority;

- Having an indefinite term labor contract or a contract with a term of 1 year or more with employers in Vietnam;

- Under 60 years old for male and under 55 for female.

- Not subject to internal transfer within the enterprise as stipulated in Clause 1, Article 3 of Decree No. 11/2016 / ND-CP.

This provision has given more specific guidance to authorities in the application of new regulations on compulsory insurance participation for foreigners.

3. Personal Income Tax (PIT) for share transfer of individuals in joint stock companies

The General Department of Taxation issued Official Letter No. 1211/TCT-DNNCN on 4 April 2019 guiding tax policies for shares transfer of individuals in JSC.

Accordingly, based on the regulations on PIT, Enterprise Law and Securities Law, "share" is a form of "stock", hence individuals transferring capital in JSC according to Enterprise Law and Securities Law is defined as income from securities transfer and declare and pay PIT at 0.1% rate on transaction price.

4. Guidance on allocation of reduced PIT in 2018 of employees in economic zones

The General Department of Taxation has issued Official Letter No. 1285/TCT-DNNCN dated 8 April 2019 guiding on how to determine the PIT reduction of employees working in an Economic Zone (EZ) on 2018 PIT finalization.

In 2018, the regulation on 50% personal income tax reduction for employees working in an economic zone was abolished under Decree No. 82/2018/ND-CP. Therefore, workers working in the economic zone are only entitled to a reduction of PIT from 1 January 2018 to 9 July 2018, no reduction is applicable afterwards. It means that since 10 July 2018, workers working in an economic zone will have to pay 100% of PIT and no longer enjoy the same incentives as before.

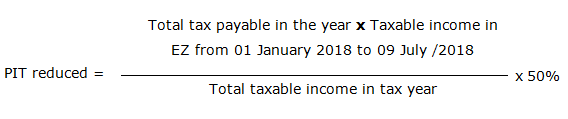

The Official Letter 1285 guides how to calculate the PIT amount to be reduced in 2018 for employees working in an Economic Zone as follows:

In which:

In which:

Total PIT payable in a year is determined on the basis of taxable income from wages and salaries arising in the tax calculation year in accordance with the law on PIT.

Total taxable income in the tax year is taxable income from wages and personal salaries, including income received inside and outside an EZ.

During implementation, if any problems arise in determining the criteria in the allocation formula, enterprises may consider to getting confirmation from local tax authorities before implementing to mitigate the risk in the future.

5. Transfer Pricing documentation (Master File) for enterprise whose parent company is not a multinational corporation but established under Vietnamese regulations

The Binh Duong Tax Department issued Official Letter No. 1558/CT-TT & HT dated 31 January 2019 guiding the preparation of the Master file and the Country by Country report for enterprises with Vietnamese parent companies, which are not multinational corporations.

Accordingly, in case the enterprise has related party transactions with a holding company with 51% of contributed capital whose parent company is an enterprise established under Vietnamese law and not a multinational corporation will not be required to prepare Master File in accordance with Form 03 and Country by Country report of the Ultimate Parent Company accordance with Form No. 04 issued together with Decree No 20/2017/ND-CP.

Please contact the Grant Thornton consultants in case you need more professional advice regarding to the application of tax, accounting, transfer pricing, labor policies, investment and customs as well as other legal policy problems in the business process of enterprises.