-

International Financial Reporting Advisory Services

IFRS reporting advisory serivces of Grant Thornton are carried out by our dedicated team with expertise in IFRS implementation.

-

Audit Services

• Statutory audit • Review of financial statements and financial information • Agreed-upon procedures • FRAS services • Compilation of financial information • Reporting accountant • Cross-border audit • US GAAP audit

-

Audit Quality

We have various methods of monitoring our system of quality control and engagement quality, including real-time involvement of coaches and national office personnel on select audit engagements, reviews of issuer audit engagements prior to archiving by someone outside of the engagement team, and internal inspections of assurance engagements and the system of quality control.

-

Audit Approach

Audit Approach

-

Licensing services

Licensing services

-

International tax planning

Our extensive international network provides us with significant resources to meet all your expansion goals. We strive to develop commercially focused and tailored tax strategies to minimise tax exposures and maximise business efficiency.

-

Expatriate tax planning

We have a broad knowledge base and skills to assist you keep your personal income taxes to a legitimate and reasonable level, while remaining compliant with legislation. We can develop a personalised package for each key employee to take maximum advantage of the exemptions and incentives available.

-

Tax advisory

We will review the proposed business model and transactions and advise on tax implications and recommendations to optimize the tax opportunities under the local regulations and treaties which Vietnam entered into. Furthermore, we coordinate with our GT global tax team to provide a comprehensive tax advisory for the countries involved in the business model and transactions.

-

Tax compliance services

This service is designed to assist enterprises to cope with the statutory tax declaration requirements in line with the Vietnamese tax laws as well as the frequent changes and updates in tax laws.

-

Tax health check

Our Tax Health Check involves a high-level review of specific tax areas to highlight the key issues that need to be rectified in order to reduce tax risks. Through our extensive experience, we have identified key risk areas in which many enterprises are not fully compliant or often overlook potential tax planning opportunities. Our tax health check service represents a cost-effective method to proactively manage risks and reduce potential issues arising as a result of a tax inspection.

-

Transfer Pricing

Transfer pricing is a pervasive tax issue among multinational companies. In Vietnam, the tax authorities require special documentation to report related party transactions. Compliance with transfer pricing regulations is an important aspect of doing business effectively in Vietnam as failure to do so may result in significant penalties.

-

Tax due diligence

We conduct tax due diligence reviews of target companies to analyse their tax exposure and position in relation to acquisitions, mergers or consolidations. We are able to integrate this service with our Advisory Services department in order to offer a comprehensive, holistic due diligence review.

-

Customs and international trade

Our experienced professionals can help you manage customs issues more effectively through valuation planning and making use of available free trade agreements. We also assist Clients in optimising their customs procedures by making use of potential duty exemptions and efficient import-export structures. Risk mitigation activities include customs audit defense and compliance reviews.

-

M&A Transaction

We advise numerous foreign investors on efficient tax structures for their investments. Our experience allows you to consider all the options and set up a corporate structure that meets both operational and tax efficiency requirements. In short, the structure that is best for you.

-

Industrial Zones – Picking A Location For Your Business

Grant Thornton Vietnam’s one-stop services are designed to provide comprehensive support to both new and current investors who are planning to expand or restructure their business in Vietnam. Our professionals have established strong working relationships with landlords, property developers and authorities at various localities. With extensive experiences in liaison with the relevant agencies, we offer assistance including negotiation on land rental rates and efficient management of licensing process. Our customized and flexible solutions can bring benefits of cost efficient location, accelerate licensing process, and optimize tax opportunities while remaining in compliance with legislation.

-

Tax Audit Support

Tax audit support services provide comprehensive assistance to your business in Vietnam. Recent tax practices have shown the general tendency of launching routine tax audit on yearly basis. Tax authorities have been effectively using more sophisticated methods to identify target entities from across different industry sectors.

-

Business Risk Services

Business Risk Services

-

Transaction Advisory Services

Transaction Advisory Services

-

Valuation

Valuation

-

Business consulting services

Finance Management Advisory

-

Accounting services

Accounting services

-

Taxes compliance within outsourcing

Taxes compliance within outsourcing

-

Payroll, personal income tax and labor compliance

Payroll, personal income tax and labor compliance

-

Secondments/Loan staff services

Secondments/Loan staff services

-

Compilation of the financial and non-financial information

Compilation of the financial and non-financial information

-

Accounting systems review and improvement

Accounting systems review and improvement

-

Initial setting-up for accounting and taxes systems

Initial setting-up for accounting and taxes systems

-

Management accounting and analysis

Management accounting and analysis

-

Comprehensive ERP system solution

ERP software is a tool for business operations, production management, order processing and inventory in the business process. Today, ERP software for small and medium businesses has been greatly improved to help businesses manage their business better. The article below will answer all relevant information about what ERP software is and offer the most suitable ERP solution for businesses. Let's follow along!

-

Analyze Business Administration data

We believe in the value that data can bring to the success and development of every business. Our team helps design data architecture supported by tools, to support business governance and provide useful information to management.

-

Financial reporting compliance solution package

Putting financial issues at the heart, this service helps ensure that financial reports for customers comply with both the requirements of Vietnamese accounting regulations and standards (VAS) as well as reporting standards. international finance (IFRS).

-

Third-party ERP extensions

ERP is a long-term solution that requires long-term travel, not short-term. We understand that many businesses cannot deploy the entire ERP system at once due to many different reasons, instead businesses can deploy each part. Over time, these solutions can be expanded to accommodate improved business processes or can even link completely new processes across different departments.

-

Localize, deploy and rebuild the project

Quite a few ERP projects need to be implemented according to current Vietnamese requirements and regulations, but still comply with common international business requirements. These projects need some improvements and adjustments in the right direction.

-

Consulting on technology solutions

We support the selection and implementation of the most suitable solutions, ensuring business efficiency and performance. We will work closely with customers to plan, evaluate and implement the right technology investment strategies and solutions to meet the development needs of businesses.

-

Offshore company establishment service

Using the offshore company model will facilitate the owner in the process of transaction and expand overseas markets, take advantage of the tax policy with many incentives and protect the value of the family enterprise's assets.

-

Private Trust Advisory

The development of the economy with many modern financial instruments has brought many advantages and opportunities for the enterprises, but there are still certain potential risks in any type of business. So how to protect your asset value with an appropriate company structure while stay compliance with relevant regulations?

-

Our values

We have six CLEARR values that underpin our culture and are embedded in everything we do.

-

Learning & development

At Grant Thornton we believe learning and development opportunities help to unlock your potential for growth, allowing you to be at your best every day. And when you are at your best, we are the best at serving our clients

-

Global talent mobility

One of the biggest attractions of a career with Grant Thornton is the opportunity to work on cross-border projects all over the world.

-

Diversity

Diversity helps us meet the demands of a changing world. We value the fact that our people come from all walks of life and that this diversity of experience and perspective makes our organisation stronger as a result.

-

Contact us

Contact us

-

Available positions

Experienced hires

-

Available positions

Available positions

Grant Thornton Vietnam today released the results of the Vietnam Hotel Survey 2017. The report this year marks the 14 consecutive year of Grant Thornton conducting the only comprehensive research on high-end hotels and resorts in Vietnam. This year’s survey, in line with last year’s, does not include 3 star hotels because of the level of response and change in hotel mix in this category, and we focus on the upscale hotel industry, covering 4 and 5-Star hotels.

Tourism Industry in Vietnam

2016 is considered to have been a “fantastic year with history-making results”. The Vietnamese Tourism Industry saw an increase in both to an all-time high, with 26% increase in total foreign visitor arrivals and an18.4% increase in total revenue. In 2016, Vietnam welcomed 72 million domestic and International visitors, higher than the target of 68.5 million visitors as set out by Vietnam National Administration of Tourism (VNAT). This is a remarkable achievement considering the ecological disaster in the Central coast, which haunted the industry in mid-year 2016, and where the number of visitor dropped significantly. The Vietnam Tourism Industry recorded a record 10 million international visitors and the highest yearly increase of 2 million international visitors

To accommodate the increasing arrivals for leisure and recreation, new hotels have been completed across the country. Over 8,700 rooms from 41 new 3-5 star hotels came into operation in 2016, increasing the total number of rooms to over 420,000 rooms, much higher than the number of neighbouring countries like Malaysia, Laos, and Cambodia.

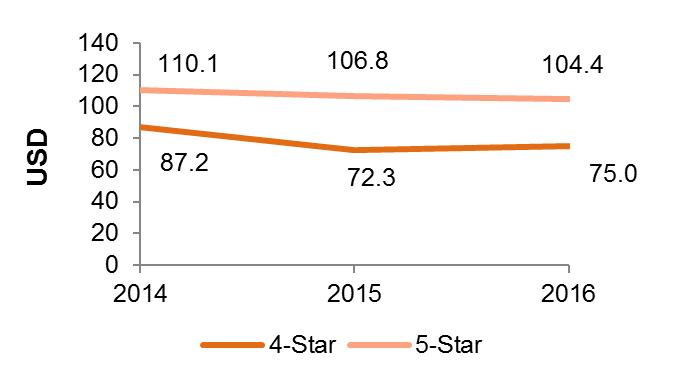

Average Room Rate

The analysis of upscale hotels was performed by Star Ranking and Region. By Star Ranking, Room Rate for 4-Star hotels in 2016 started to pick up reaching USD75.0, recording an increase of 3.8% but still far behind the 2014 level. However, 5-Star hotels continued to see their rates dropped slightly by 2.2% from USD106.8 in 2015 to USD104.4 in 2016. The annual overall average room rate of upscale hotels in 2016 increased from USD87.0 in 2015 to USD88.1 in 2016.

____________________________________________

AVERAGE ROOM RATE BY STAR RANKING (2014- 2016)

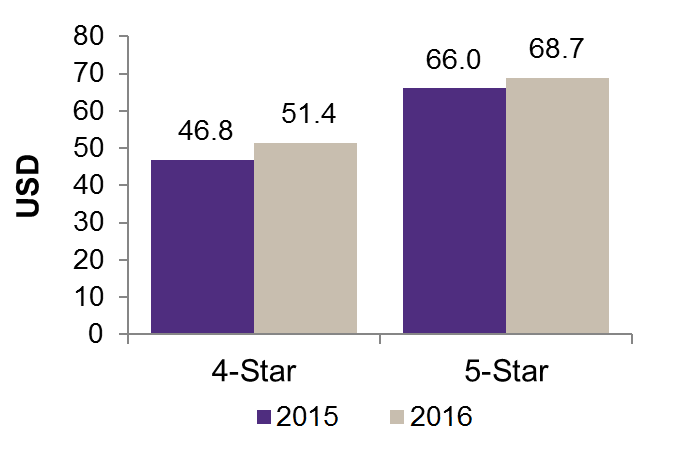

RevPAR

RevPAR for Hotels increased in both Star categories, with a 10% rise at 4-Star hotels and 4.1% rise in 5-Star hotels.

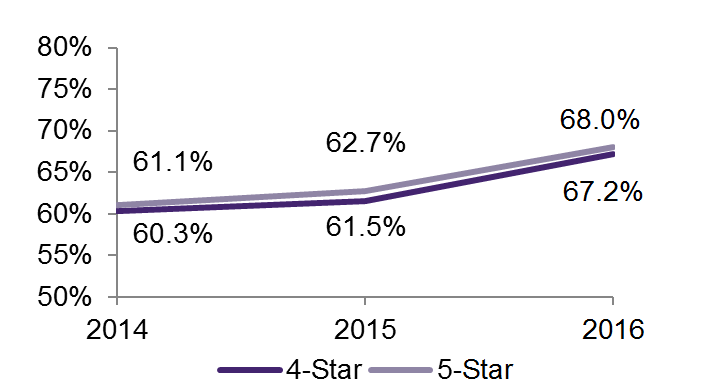

Year 2016 marked a year of recovery with Occupancy Rates in general increasing for both Star Rankings. However, with the expanding room inventory and a lot of projects scheduled to launch in the near future, the competition in the upscale hotel market will start to heat up, especially for 5-Star hotels.

______________________________________________

MOVEMENT IN HOTEL ROOM REVPAR BY STAR RANKING (2015 – 2016)

*RevPAR = Revenue Per Available Room

______________________________________________AVERAGE HOTEL ROOM OCCUPANCY RATE BY STAR RANKING (2014 – 2016)

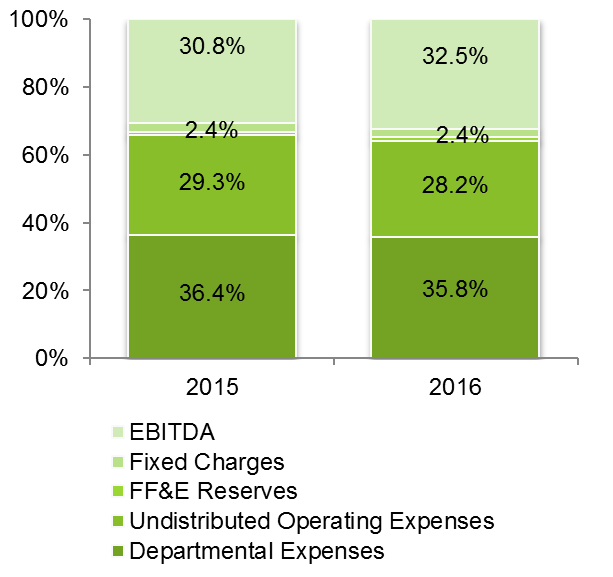

Profitability

In 2016, the upscale hotel sector saw a better year with EBITDA margin increased by 1.7%. While the proportion of Fixed Charges and FF&E – Furniture, Fixtures and Equipment Reserves remained nearly the same for both years, the improvement in EBITDA was largely contributed by the positive change in both Departmental Expenses and Undistributed Operating Expenses.

______________________________________________

EXPENSES AND PROFIT AS PERCENTAGE OF REVENUE (2015 – 2016)

Regarding purpose of stay, Individual tourists, Tour groups and Business travellers together comprised for over three quarters (77.6%) of total guests staying in high-end hotels in 2016. Looking at 4-Star and 5-Star hotels separately, the three segments made up for 83.1% and 71.8%, respectively.

Generally, the structure of room reservations followed the same pattern as in 2015. The largest channel to reserve the accommodation at 4-Star and 5-Star properties is still Travel agents and Tour Operators with 37.3%. This ratio, however showed a gradual decline throughout the years, and decreasing further by 3.1% compared to 2015.

With regards to Star Ranking analysis, 4-Star hotels have the higher ratio of booking via Travel agents and Tour Operators at 41.3%, while the 5-Star hotels have 32.5% of its sales via this channel.

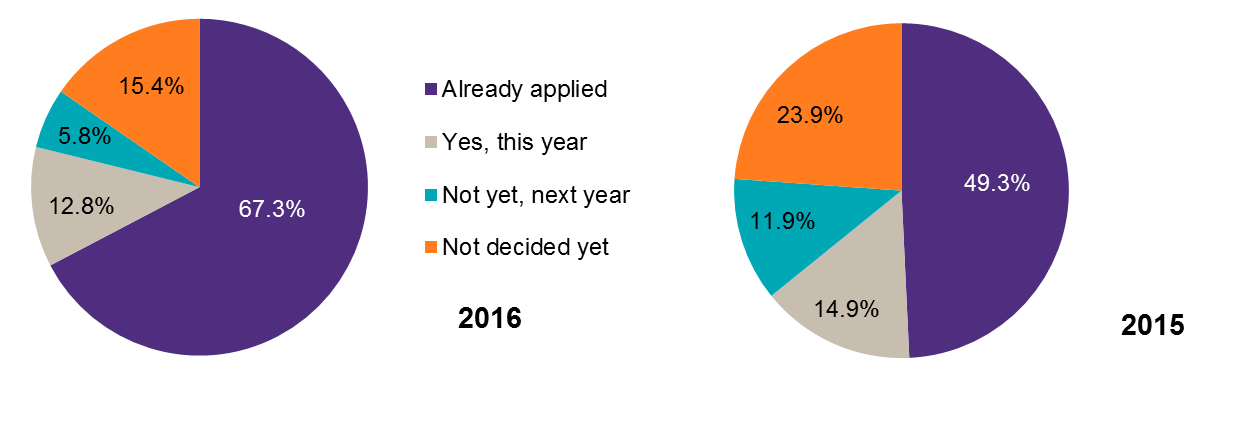

2016 saw an increase in the number of hotels who have decided that digital technology is vital to their business to help combat growing competition and to set them apart from those older hotels or those with an older mindset.

______________________________________________

WHEN HOTELS WILL APPLY DIGITAL TECHNOLOGY INTO THEIR BUSINESS

With the 4th Industry Revolution affecting all sectors of the economy, many high-end Hoteliers have prepared fully for what is to come. A notable increase was observed for the application of digital technology from the previous year’s 49.3% of the hotels to 67.3% in 2016. Added to that, 18.6% of the hotels decided to implement further use of technology either in this year or next year. Of those who responded that they have not made any decision, most of them are hotels from the Central and Southern Region, and the proportion of this group dropped from 23.9% in 2015 to 15.4% in 2016.

Copies of Grant Thornton Vietnam’s Hotel Survey 2017 can be ordered by visiting Grant Thornton Vietnam’s website, www.grantthornton.com.vn, or by contacting Grant Thornton on +84 8 3910 9100. An Executive Summary of the survey report is also available for download from the website. 100% of the proceeds raised from sales of the Hotel Survey 2017 will be donated to Newborns Vietnam, a United Kingdom registered charity in Vietnam, dedicated to reducing neonatal mortality in South East Asia, with a specific focus on Danang, Vietnam.

- The end -

Further enquiries, please contact:

Kenneth Atkinson

Executive Chairman

T +84 28 3910 9100

E: Ken.Atkinson@vn.gt.com

Ngo Thi Kim Van

Marketing and Communication Manager

T +84 90 9044 214

E: Van.Ngo@vn.gt.com